About Our Company

Your reliable service provider in doing business in the Philippines!

The group positions itself as a company that you can trust with your incorporation needs at the most competitive market rate.

Our team of lawyers are seasoned professionals in their field ranging from Corporate Law, Labor, and even Maritime Law. And with over 1000 clients served from 2013, CIP is a company you can count on to deliver because we know that time is gold.

We've assisted over 1,000 businesses (locals or foreigners) setup your company in the Philippines. Our affordable pricing, simplified processes and honest and straight-forward advise made us the choice for many so why not contact us for your company incorporation needs today.

Our Services

We are your One-Stop-Shop service provider for all your accounting and business compliance needs. We assist in establishing and running the business smoothly and reach its fullest potential. Be well guided and worry free. Engage us today.

Individual Registration

Are used by professionals who wants to practice their profession or skills. They are commonly known as consultants or free lancers. The individual registrations are registered directly with the BIR and may operate.

Sole Proprietorship

Anybody of legal age who wants to start a business can register a sole prop. Unlike a corporation a sole prop is not limited liability. A foreigner may also register but there is a required capital. Sole Prop registration is the fastest way to register a business.

One Person Corporation

OPC has the same limited liabilities as the traditional corporation. Foreigners are allowed if they can comply with the requirements. The OPC requires 2 nominees and must declare a Treasurer, if not they must secure a surety bond.

Domestic Incorporation

Domestic corp. may have 2-15 incorporators. Foreigner may also be part of a domestic corp. as long as they have less than 40% of the share hold. A domestic corporation comparable to a Limited or LLC.

Foreign Domestic Corporation

A foreign corporation that started here in the Philippines, Mostly composed of foreigners.

Foreign Corporation

Foreign Incorporation is a corporation that is majority owned by foreigners, this could be by share ownership or number of incorporators. There are two types of Foreign Incorporation, they are Representative Office or Branch Office.

Representative Office

While the Branch office is allowed to generate income locally, the representative office is not. Representative office registration is commonly used by customer support related business models. Such as BPO’s etc. The minimum capital requirement for a representative office is $30,000.

Branch Office

It is a foreign registration that originates outside the Philippines. It can operate in the Philippines the same way it would from its origin. The minimum capital that is required is $200,000.

What's Included?

Virtual Office Address

(If needed) we can off er a competitive virtual office address to package with your incorporation nee.

Free 45 Min consultation

with Partner Accounting Firm to discuss your responsibility as a new business owner in The Philippines.

Free 45 Min consultation

with our Legal Partners on other legal matters.

What do you need to prepare

Signed Contract

Filled out Registration Form

All 2 Incorporators’ or Sole Prop owner’s

Tax Identification Number (TIN)

Business Address

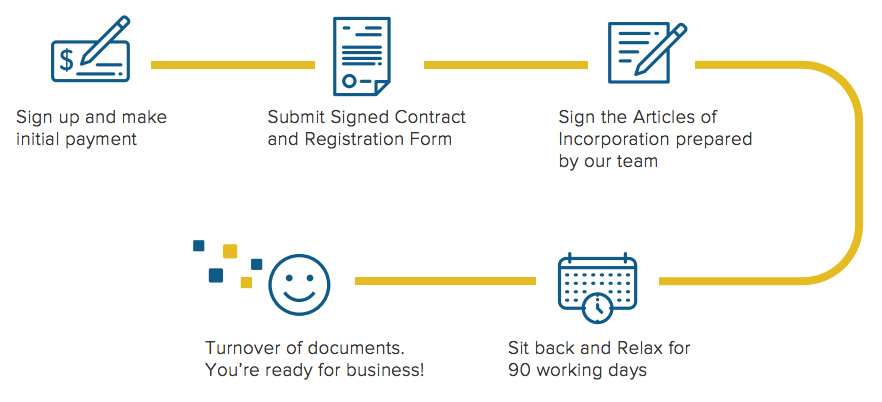

The Process

How much? |

|

|---|---|

| Individual Registration

Note: This is a registration specifically for practicing professionals such as Doctors, Nurses, Architects |

PHP7,000 |

| Sole Proprietorship | PHP12,000 |

| One Person Corporation | PHP20,000 |

| Domestic Incorporation | PHP35,000 |

| Foreign Incorporation | Starts at PHP65,000 |

| Quarterly Business Permit Renewal | PHP6,000 |

| SSS, Phil-health, Pag-Ibig, other government agency related application | PHP5,000 |

| Post-SEC (BIR and LGU only) | PHP20,000 |

| Post-DTI (BIR and LGU only) | PHP10,000 |

Payment Schedule

50%

Professional Fee upon engagement

100%

Government Fund

50%

Upon Completion

Best Package Deals

Best Seller

Full DTI

Registration

DTI Registration — Great for starting up. Easy to setup and maintain. Only available to Filipino.

Professional Fee:

Only PHP12,000

All inclusive

Get a QuoteOne Person

Corporation

SEC Registration — You only need 1 incorporator for this company structure.

Professional Fee:

Only PHP20,000

All inclusive

Get a QuoteCompany Incorporation — Post SEC Only

Most common and recommended company structure. At least 60% of the shareholders must be Filipino.

Professional Fee:

Only PHP25,000

All inclusive

Get a QuoteBest Seller

Full Company Corporation

SEC Registration — Most large / foreign owned companies uses this Company Structure.

Professional Fee:

From PHP35,000

All inclusive

Get a QuoteHighly Recommended

Company Incorporation + Virtual Office

SEC Registration with 12 Months of Virtual Office Basic (Business Address and Mail Handling).

Professional Fee:

From PHP45,000

All inclusive

Get a QuoteNote: The service fee listed is VAT inclusive. Government fees not included.

What's included?

Registration with the Bureau of Internal Revenue (BIR)

- BIR (Bureau of Internal Revenue)

- Application for 'Authority to Print'

- Books of Account

- Annual Registration (0605)

- DST Doc Stamp for Lease

- DST Doc Stamp for Subscribed Capital

LGU (Local Government Units) Permits

- LGU

- Barangay Permit

- Mayor's Permit

- Fire and Safety

- Zoning Permit

- Location Clearance

- Insurance (CGL)

Unsure About Which Company Structure Is Best for You?

Speak to our experienced team. We can assist you with determining the best company structure based on your business idea and requirements.

Questions? Ask us!

Need Some Help?

Speak to Our Team

Contact us and get a free, non-binding consultation with our team where you can consult your business idea, assess legal implications of the relevant business structures and ask any questions you may have. We are happy to meet you in our office or talk to you on the phone